Got GOALS? Sun Life Asset Management's Solution: Prosperity Achiever Funds

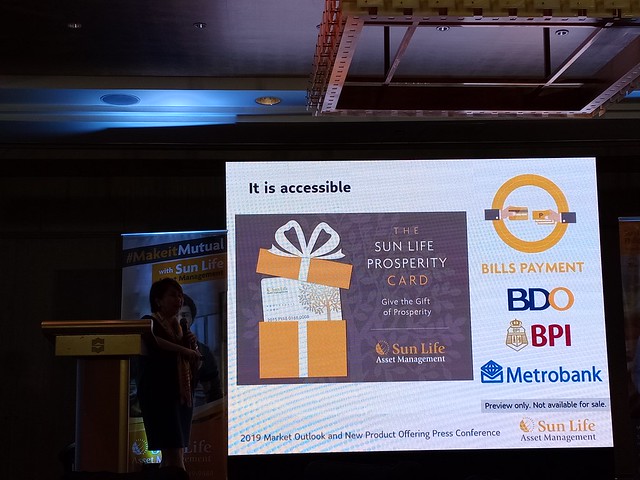

While we all know that mutual funds are a big help when it comes to letting your money grow by itself, Sun Life has created a better solution for those who have goals of say, getting a house or their children education funds for college. The Sunlife Prosperity Achiever Funds.

What is the Prosperity Achiever Funds?

When it comes to investing with Mutual Funds, I always prefer long term and moderate to high risk investments, depending on the state of things, or the economy we have recently. That's what is listed with my Financial Advisor to do just that... But ultimately, why I prefer long term is because I intended to use the possible earnings from the mutual funds to help out with my kid's college tuition when the time comes.

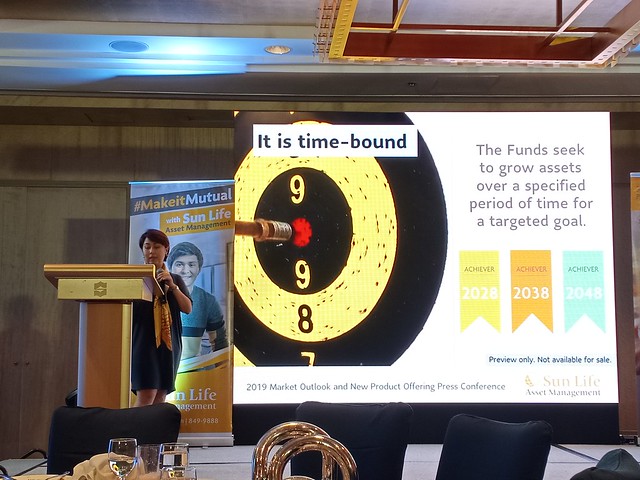

The Sun Life Prosperity Achiever funds is a time bound mutual fund, or what you call target date maturity. The idea is to invest your money on equities or stocks that may yield high returns, and they use a so called glide system where SLAMCI's pro fund managers will systematically move the assets of your funds to fixed income, and these funds become less agressive as their target dates near.

You may think that it's not a good time to invest with the economy's crazy roller coaster track rececntly, filled with inflation peaking and rising prices, but actually, despite the low market, this is THE best time for you to start having an investment plan.

Why?

Because when the time comes the value of units goes higher, (and it will) the earnings will go higher as well.

This is also another reason why it is better to do long term investing instead of the shorter and high risk ones, because you are at least sure to not have much loss and more gain with the money you put in mutual funds.

The Prosperity Achiever Funds will be available in early 2019.. So alam na saan dapat ilagay ang mga napamasko! :D

To know more about the Sun Life Prosperity Achiever Funds, visit the official website or consult a Sun Life Financial Advisor. You may also call (02) 849-9888.

Types of Achiever Funds

Achiever Fund 2028 (10 years)

The Prosperity Achiever Fund 2028 is suitable for investors with a 10-year investment horizon, and may be hoping to purchase of a car or set-up of a small business.

Achiever Fund 2038 (20 years)

The Prosperity Achiever Fund 2038 is ideal for investors with a 20-year investment horizon. Ideal for those in their 30s or 40s, it is recommended for those who may be looking to prepare for cost of their child's education or aiming to purchase a house.

Achiever Fund 2048 (30 years)

The Prosperity Achiever Fund 2048 meanwhile, is the best choice for investors with a 30-year investment horizon. It will work well for those in their 20s or 30s, as it will enable then milestone purchases, or prepare for their retirement.

You may think that it's not a good time to invest with the economy's crazy roller coaster track rececntly, filled with inflation peaking and rising prices, but actually, despite the low market, this is THE best time for you to start having an investment plan.

Why?

Because when the time comes the value of units goes higher, (and it will) the earnings will go higher as well.

This is also another reason why it is better to do long term investing instead of the shorter and high risk ones, because you are at least sure to not have much loss and more gain with the money you put in mutual funds.

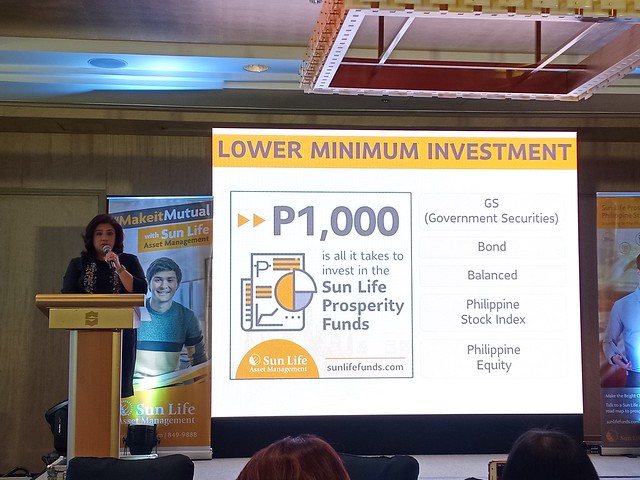

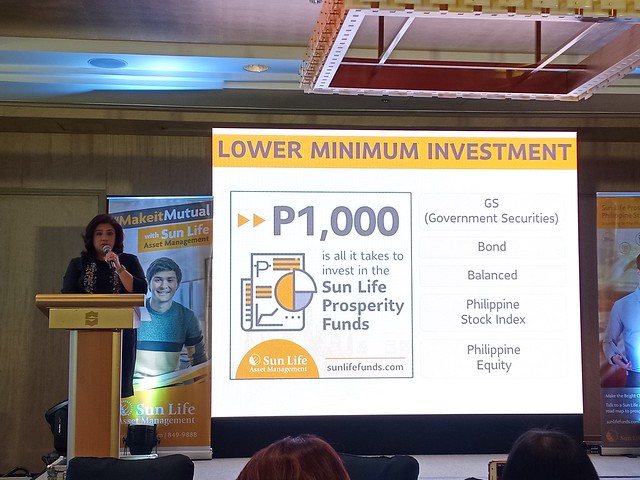

PS: The minimum amount to invest in different Sun Life Mutual Funds Programs are now 1,000 PHP!

The Prosperity Achiever Funds will be available in early 2019.. So alam na saan dapat ilagay ang mga napamasko! :D

To know more about the Sun Life Prosperity Achiever Funds, visit the official website or consult a Sun Life Financial Advisor. You may also call (02) 849-9888.

.jpg)

No comments