EASY DIY Investing with 100 Pesos, A Selfie and Sunlife's Market Outlook for 2020

Investing does not have to mean big capitals with what Sunlife Asset Management Company Inc. unvelied a couple of days ago. The trend lately is that Millennials are in to saving up for travels and experiences, starting up a business and then there's education- be it to better themselves or give education to their own siblings or kiddos.

Personally, I had a little trouble starting out with investing as well- on where to put it, how to get in the mutual funds or stocks business. There was also the point of looking for a financial advisor who is actually willing to be there when I need something, and of course the piles of papers and signing things. It was daunting, but Sunlife is definitely giving us a better choice to end the Holiday Season!

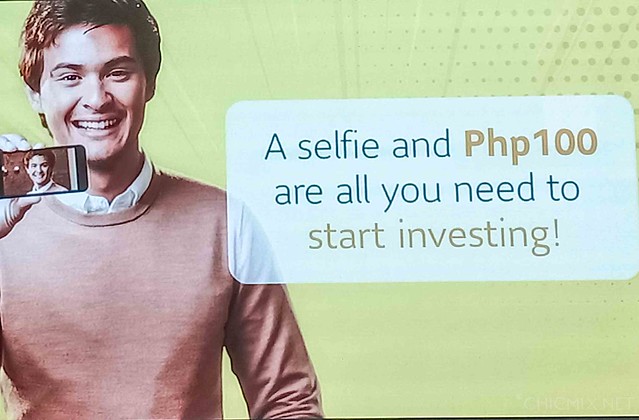

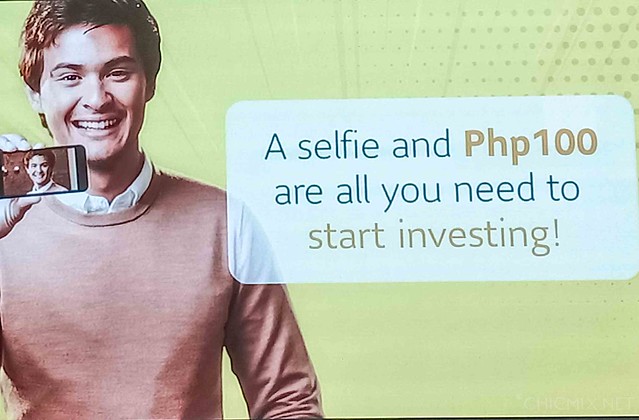

Yes. All you will need is 100 pesos to start up your account, and once you've started, you can add in a little more later and let it grow! If you play your cards right, you can get that dream vacation you've always wanted, have an account you can save for emergencies or save up for your kid's college.

How? You will have to open up an account online via sunlifefunds.com, or via their mobile app. Sign up, add in your selfie so they have a face to the name. And to make things more affordable, you invest in Money Market for as low as 100 pesos.

I myself started with 5000 Pesos with a Sunlife Prosperity card a couple of years ago, but right now it is also easier to start in with a minimum of 1000 pesos for the Bond funds and the Equitable funds. After getting started, adding a thousand or a couple hundred pesos into that account and letting it grow is easy. It can also double as a dieting method cause a milk tea or frap definitely costs a couple hundred pesos.

Sun Life Asset Management Company Inc. recently held their yearly market outlook report for the year 2020. While things have gone kinda bad this year, I do know and saw from SLAMCI's Market outlook that things are generally going to turn out for the better starting now. They believe that the Philippine Economy is ready to rise from the ashes and is poised to get bigger and grow faster for 2020.

"After reviewing the fundamentals, we are confident that the economy is set to significantly improve in the coming vear" Sun Life Chief Investments Officer Michael Enriquez said. "While we can still expect challenges along the way these should be tolerable and may be balanced by the positive developments"

Among the factors that are expected to boost the Philippine economy next year are lower prices and accelerated government spending, with full force on capital outlays. This is due to the administration having only two years left in its mandate. "While inflation fell to a low of 0.8% in October 2019, we expect prices to slowly inch up as we foresee the year 2020 inflation at 2.4%. This figure is much lower than 2018 inflation of 5.21% Enriquez said.

For currency, Enriquez said that a range of PHP 50.70 to PHP 52.50 to a dollar is possible. "Our year-2019 USD- PHP forecast is at 51.00, and 2020 slightly higher at 52.50," he explained. On the equities front, while 2019 remains to be a fairly volatile year, Sun Life expects the Philippine Stock Exchange index to end at 8,600 on a best-case scenario. "Our PSEI target for 2020 is at 9,460 with a price-earnings multiple of 18.2 times, while we foresee the earnings to have a growth rate of 10.40%," Enriquez said.

Sunlife Kaakbay Campaign: On Finding the perfect Lifetime Partner

Personally, I had a little trouble starting out with investing as well- on where to put it, how to get in the mutual funds or stocks business. There was also the point of looking for a financial advisor who is actually willing to be there when I need something, and of course the piles of papers and signing things. It was daunting, but Sunlife is definitely giving us a better choice to end the Holiday Season!

Invest with 100 Pesos, a selfie and internet data

Yes. All you will need is 100 pesos to start up your account, and once you've started, you can add in a little more later and let it grow! If you play your cards right, you can get that dream vacation you've always wanted, have an account you can save for emergencies or save up for your kid's college.

How? You will have to open up an account online via sunlifefunds.com, or via their mobile app. Sign up, add in your selfie so they have a face to the name. And to make things more affordable, you invest in Money Market for as low as 100 pesos.

I myself started with 5000 Pesos with a Sunlife Prosperity card a couple of years ago, but right now it is also easier to start in with a minimum of 1000 pesos for the Bond funds and the Equitable funds. After getting started, adding a thousand or a couple hundred pesos into that account and letting it grow is easy. It can also double as a dieting method cause a milk tea or frap definitely costs a couple hundred pesos.

A brighter Market outlook for 2020 with Sunlife

Sun Life Asset Management Company Inc. recently held their yearly market outlook report for the year 2020. While things have gone kinda bad this year, I do know and saw from SLAMCI's Market outlook that things are generally going to turn out for the better starting now. They believe that the Philippine Economy is ready to rise from the ashes and is poised to get bigger and grow faster for 2020.

"After reviewing the fundamentals, we are confident that the economy is set to significantly improve in the coming vear" Sun Life Chief Investments Officer Michael Enriquez said. "While we can still expect challenges along the way these should be tolerable and may be balanced by the positive developments"

Among the factors that are expected to boost the Philippine economy next year are lower prices and accelerated government spending, with full force on capital outlays. This is due to the administration having only two years left in its mandate. "While inflation fell to a low of 0.8% in October 2019, we expect prices to slowly inch up as we foresee the year 2020 inflation at 2.4%. This figure is much lower than 2018 inflation of 5.21% Enriquez said.

For currency, Enriquez said that a range of PHP 50.70 to PHP 52.50 to a dollar is possible. "Our year-2019 USD- PHP forecast is at 51.00, and 2020 slightly higher at 52.50," he explained. On the equities front, while 2019 remains to be a fairly volatile year, Sun Life expects the Philippine Stock Exchange index to end at 8,600 on a best-case scenario. "Our PSEI target for 2020 is at 9,460 with a price-earnings multiple of 18.2 times, while we foresee the earnings to have a growth rate of 10.40%," Enriquez said.

Equity, Money Market or Bond Funds for 2020?

With an option to start up without a financial advisor, it would mean that you have complete control of everything. But which of the three mutual funds options should you put in this incoming year? Based on the happenings of 2019 Bond Funds surprisingly made a marginally better result than Equity funds. Money Market also made strides this year. But coming from the president of SLAMCI herself, Ms. mentioned that it is better to have parts of your money in the three options. This is to ensure that your money still grows, even if one part of the funds had a lower income, you still gain something from the other ones.

When investing, you have to think of your long term goals too. It is only with that vision and a solid commitment to your investing journey that one can benefit from a better and faster Philippine economy in 2020.

|

| President of SLAMCI, Valerie Pama |

When investing, you have to think of your long term goals too. It is only with that vision and a solid commitment to your investing journey that one can benefit from a better and faster Philippine economy in 2020.

What to read next?

Got GOALS? Sun Life Asset Management's Solution: Prosperity Achiever FundsSunlife Kaakbay Campaign: On Finding the perfect Lifetime Partner

.jpg)

Woah. Never knew about this. I will ask my financial advisor about this. I'm interested hehehe kesa masayang mga pera sa milk tea at samgyup

ReplyDeleteThis is very timely. I just got my 13th month pay and I'm thinking of investing instead of spending. Check ko nga sila. Thanks for this!

ReplyDeleteI may need to read more about this. It looks good and easy thus, I need to research.

ReplyDeleteAng galing naman. Very Helpful! Thank you for this momsh! ❤

ReplyDelete