Three Ways to Build Your Credit Score

Making it in today's world of inflation, recession, and astonishing prices is a definite challenge. Despite everything, I know you're still eyeing that new car, house, or even just a new laptop to help you out with your work. And while you wouldn't have enough funds for it at the time, there are ways to get there-like taking a small loan from the bank or a financial institution.

The sad part of this is when your credit loan gets denied-even if you seem to have everything in the green-like having a stable job with a regular salary. So what gives?

What is Credit Score

A credit score is the number you’ve got based on your ability to manage financial obligations and debt, like paying your loans back or your credit card dues. The higher credit score you have, the better. Financial institutions like banks and credit companies use your credit score to decide on whether they should give you access to credit, loans, and other financial services.

You can build your credit score with three easy steps:

Pay your dues on time.

You would start out with basic bills like electricity or water which will help out in giving you a greater chance to start on a credit card. To do this responsibly you would have to spend within your limits and make sure that you can keep track of your credit limits via budgeting. Proper payment of dues goes on your record, and you get flagged for a bad credit score if you keep missing payments. If it’s possible, make your payments automatic and use the features of your online banking apps.

Use Personal Loans to create a good payment history

You would find that most banks have a lot of dos and don'ts when checking if they can give you a credit card. Just starting out on building credit or do you want to finance that laptop that can help you out a lot for your work? You can get it via credit loan. A personal loan is one of these and is a way to help you build your credit score. Especially if you're using it for debt consolidation or for establishing a good payment history.

If you're starting out with a bad credit score, or just got blindsided by having a big emergency, personal loans are granted as a lump sum for one-time use. Managing your finances and payments via short-term financial solutions like a personal loan option is there for you.

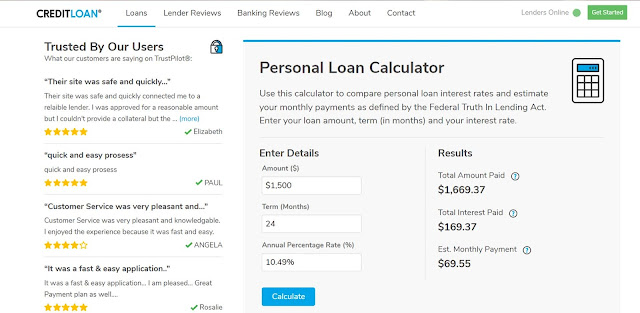

You can read more on this, complete with a how-to guide and computing for your loan with their persona loan calculator with credit loan.

.jpg)

No comments